The Only Guide to Small Business Accountant Vancouver

Wiki Article

The Best Strategy To Use For Tax Consultant Vancouver

Table of ContentsHow Pivot Advantage Accounting And Advisory Inc. In Vancouver can Save You Time, Stress, and Money.Excitement About Vancouver Tax Accounting CompanySome Known Questions About Vancouver Accounting Firm.Outsourced Cfo Services Things To Know Before You Get ThisWhat Does Vancouver Accounting Firm Mean?Not known Facts About Small Business Accountant Vancouver

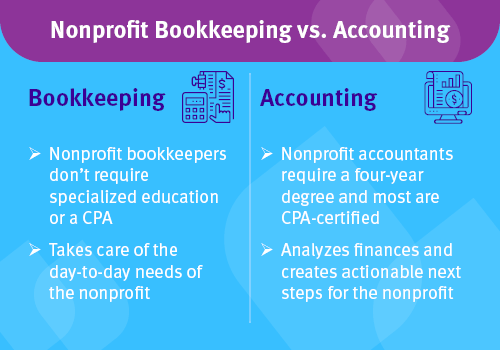

Right here are some advantages to employing an accountant over a bookkeeper: An accountant can give you a comprehensive sight of your service's financial state, together with approaches as well as referrals for making monetary decisions. At the same time, accountants are only liable for recording financial transactions. Accounting professionals are needed to complete even more education, qualifications as well as job experience than accountants.

It can be tough to assess the ideal time to employ an accountancy specialist or bookkeeper or to determine if you require one whatsoever. While numerous tiny businesses hire an accounting professional as a consultant, you have several alternatives for dealing with financial tasks. Some little company owners do their own bookkeeping on software application their accounting professional advises or makes use of, offering it to the accounting professional on a weekly, regular monthly or quarterly basis for action.

It may take some history research to locate a suitable accountant since, unlike accountants, they are not called for to hold a professional certification. A strong endorsement from a trusted associate or years of experience are important aspects when employing a bookkeeper.

Indicators on Pivot Advantage Accounting And Advisory Inc. In Vancouver You Should Know

For small companies, skilled cash money monitoring is a vital aspect of survival and also development, so it's a good idea to collaborate with a monetary expert from the beginning. If you like to go it alone, take into consideration beginning out with audit software program and keeping your books thoroughly up to date. That method, must you need to work with an expert down the line, they will certainly have exposure into the full financial history of your organization.

Some resource interviews were conducted for a previous variation of this short i thought about this article.

Our Vancouver Tax Accounting Company Ideas

When it pertains to the ins and outs of tax obligations, bookkeeping as well as finance, nevertheless, it never ever harms to have a skilled expert to browse around these guys turn to for support. A growing number of accountants are likewise caring for things such as cash money flow forecasts, invoicing and also HR. Inevitably, many of them are taking on CFO-like duties.Small company owners can anticipate their accounting professionals to aid with: Picking business framework that's right for you is necessary. It influences just how much you pay in taxes, the documents you require to submit and your individual obligation. If you're seeking to transform to a different business structure, it might cause tax consequences and various other problems.

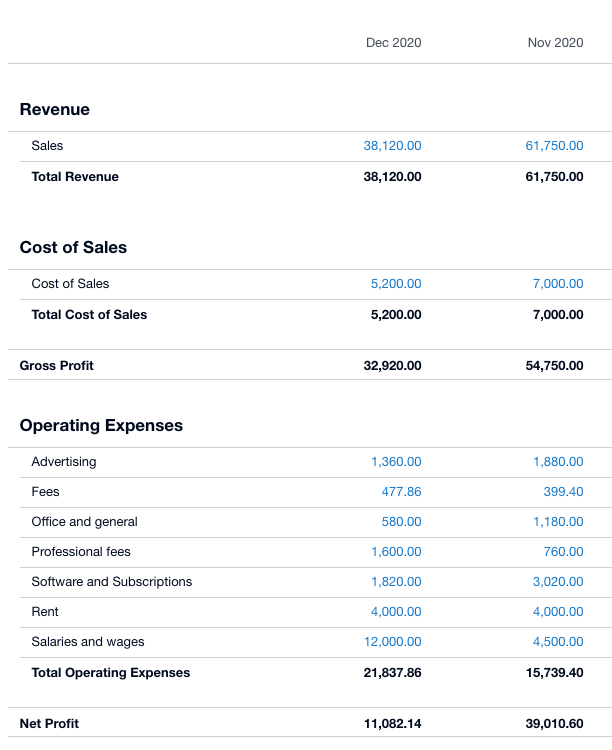

Even firms that coincide dimension and also industry pay very various amounts for bookkeeping. Before we enter into buck figures, allow's speak about the expenses that enter into small company accountancy. Overhead costs are expenses that do not straight become a profit. Though these prices do not exchange cash, they are required for running your business.

Some Known Facts About Cfo Company Vancouver.

The ordinary cost of accountancy solutions for little organization differs for each unique circumstance. The average month-to-month accountancy fees for a tiny company will certainly increase as you include extra solutions and also the jobs obtain more challenging.You can tape-record transactions and procedure payroll making use of online software program. Software application options come in all forms and dimensions.

Cfo Company Vancouver Fundamentals Explained

If you're a new organization proprietor, don't fail to remember to variable bookkeeping expenses into your budget. Management costs and accounting professional costs aren't the only bookkeeping expenditures.Your time is likewise valuable and also should be thought about when looking at audit prices. The time invested on bookkeeping tasks small accounting firms does not produce earnings.

This is not planned as legal suggestions; for additional information, please visit this site..

The Ultimate Guide To Virtual Cfo In Vancouver

:max_bytes(150000):strip_icc()/forensicaccounting-Final-85cc442c185945249461779bcf6aa1d5.jpg)

Report this wiki page